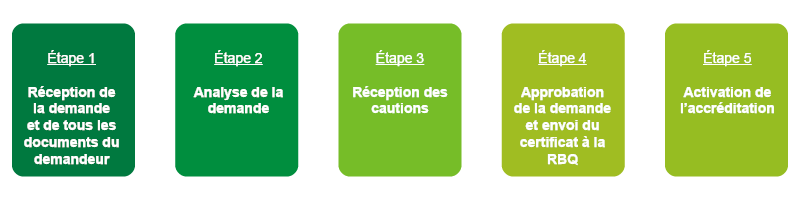

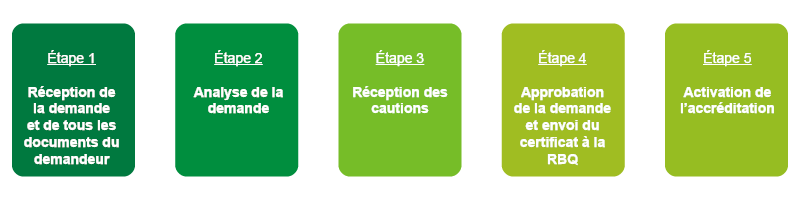

Step 1: Receipt of application and all applicant documents

Upon receipt of the application for accreditation, an confirmation of reception will be sent to you.

At this stage, GCR will check the documents received and proceed to open the file. If any documents are missing, or if the documents received are not compliant (e.g. an error in the company’s legal name or a missing signature), correspondence will be sent to you. To avoid further delays, you can use the document checklist (in French).

Please note that the application will not be transferred to the analyst until it is fully completed.

Step 2: Application analysis

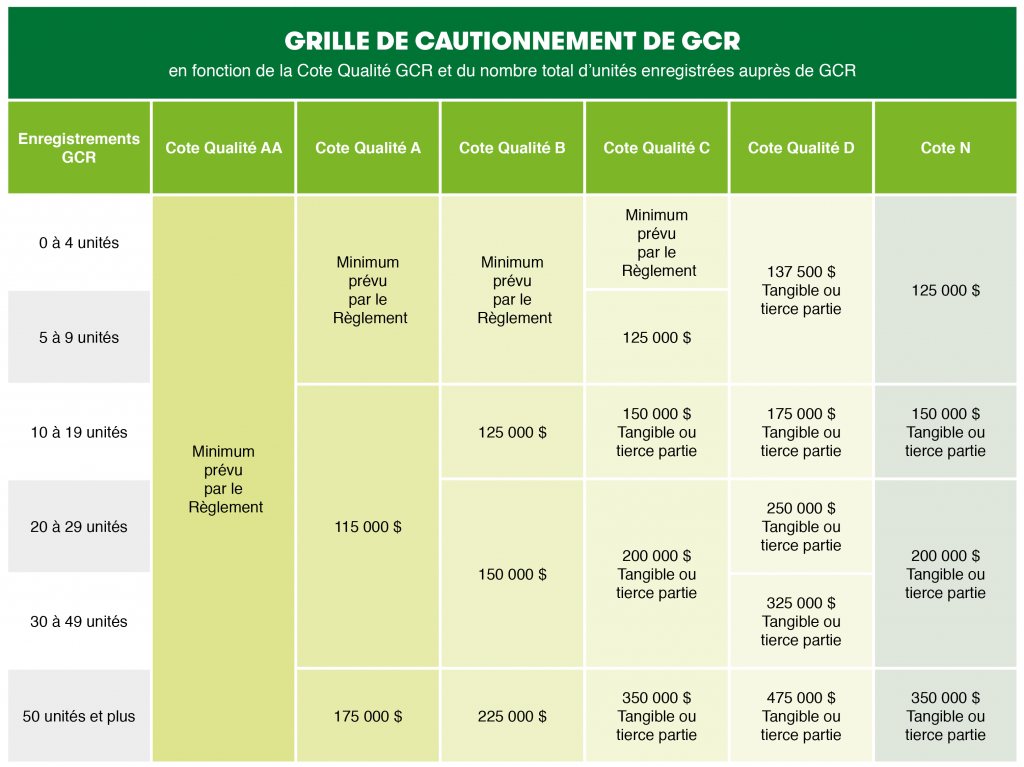

At this stage, the analyst in charge of the file will check the legal documents (Membership Agreement and Resolution of the Board of Directors) and the membership application. An analysis of the company’s financial statements and the individuals’ personal balance sheets will also be carried out at this stage. Following these analyses, the amount and type of guarantee required will be determined. Correspondence will be sent to the contractor requesting the required guarantees.

Step 3: Receipt of securities

At this stage, the contractor must provide GCR with the required bonds.

For more information on the required security bonds, please consult the Cautionnements possibles – nouvelle accréditation page (in French only).

Step 4: Approval of application and transmission of the certificate to the RBQ

Once the required guarantees have been received, the analyst will determine whether the application for accreditation is approved.

At this stage, an accreditation certificate will be sent to the Régie du Bâtiment du Québec (RBQ). The RBQ will need this certificate to issue a license with subcategories 1.1.1 and/or 1.1.2.

Step 5: Activation of accreditation

Upon receipt of confirmation from the RBQ that a license with subcategories 1.1.1 and/or 1.1.2 has been issued, GCR will activate the contractor’s accreditation.

Once the accreditation is activated, an e-mail will be sent to the contractor allowing him to create his account on the Zone GCR. By creating an account on the Zone GCR, the contractor will be able to download his accreditation certificate and register his projects. To help them familiarize themselves with their accreditation and new responsibilities, contractors will also be invited to attend an information session in the months following this step.

From this point onwards, the company’s profile will appear in the directory of accredited companies. The following information will be visible: the number of non-conformities detected during inspection (classified by level of seriousness), the number of files and points of complaint recognized, arbitration decisions and the addresses of all buildings constructed by the company and registered with GCR.