If the customer satisfaction rating is used to calculate the Cote Qualité GCR, then the financial rating counts for 40% of the Cote Qualité GCR. Otherwise, the financial rating counts for 50%.

GCR’s senior management, in concert with the Vice President of Contractor Services, has assigned an expert to fully assess the criteria of the financial rating and the securities grid.

Securities grid

The expert conducted an assessment in comparison with other guarantee plans in Canada, as well as several private insurers, and confirmed that the principle of the securities grid helps define GCR’s risk assessment in a way that is fully transparent for the contractor. The securities grid will therefore undergo no changes in the short term. However, the amounts required will change based on the risk and a contractor with a AA score will have to provide the minimum security provided for under the regulation.

Financial rating

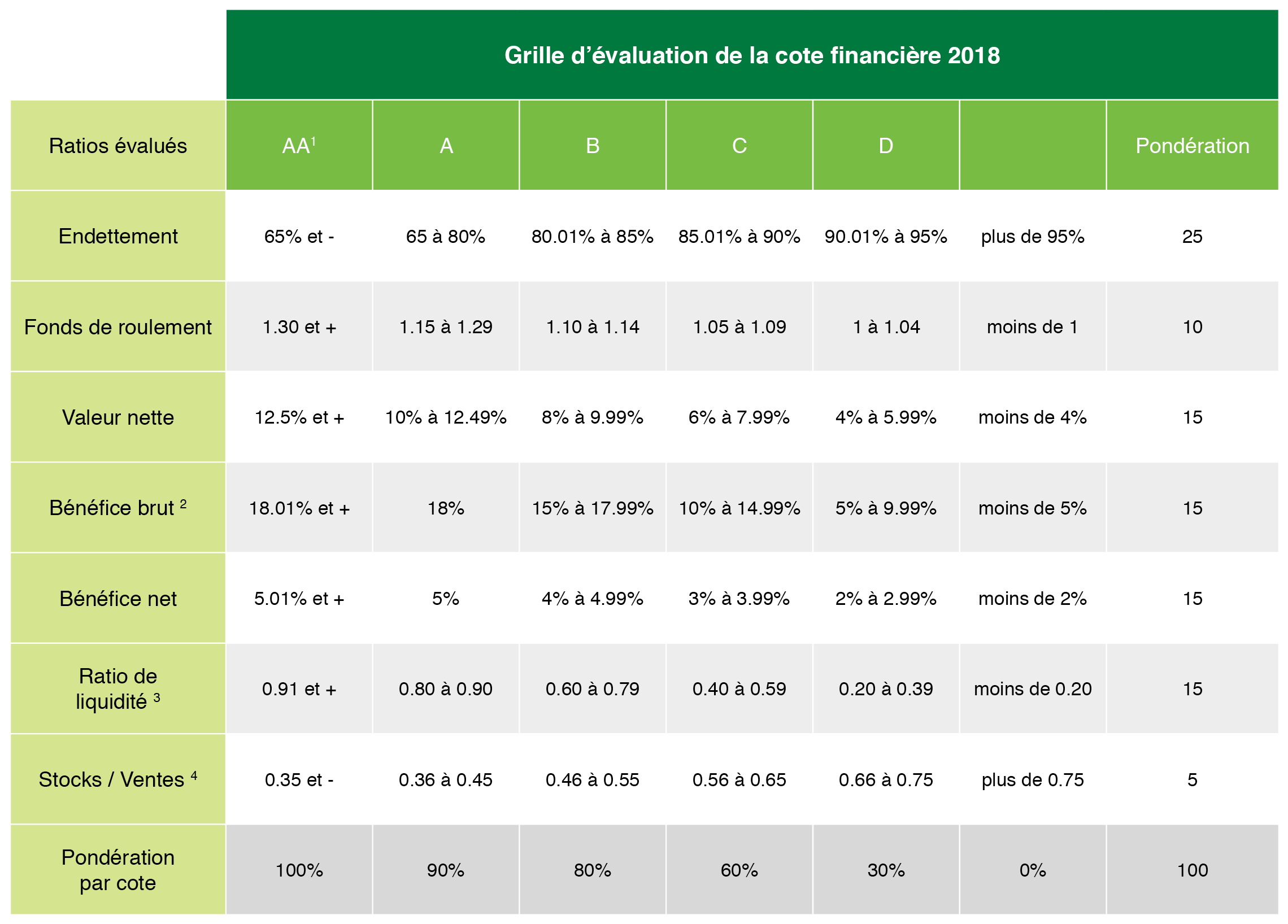

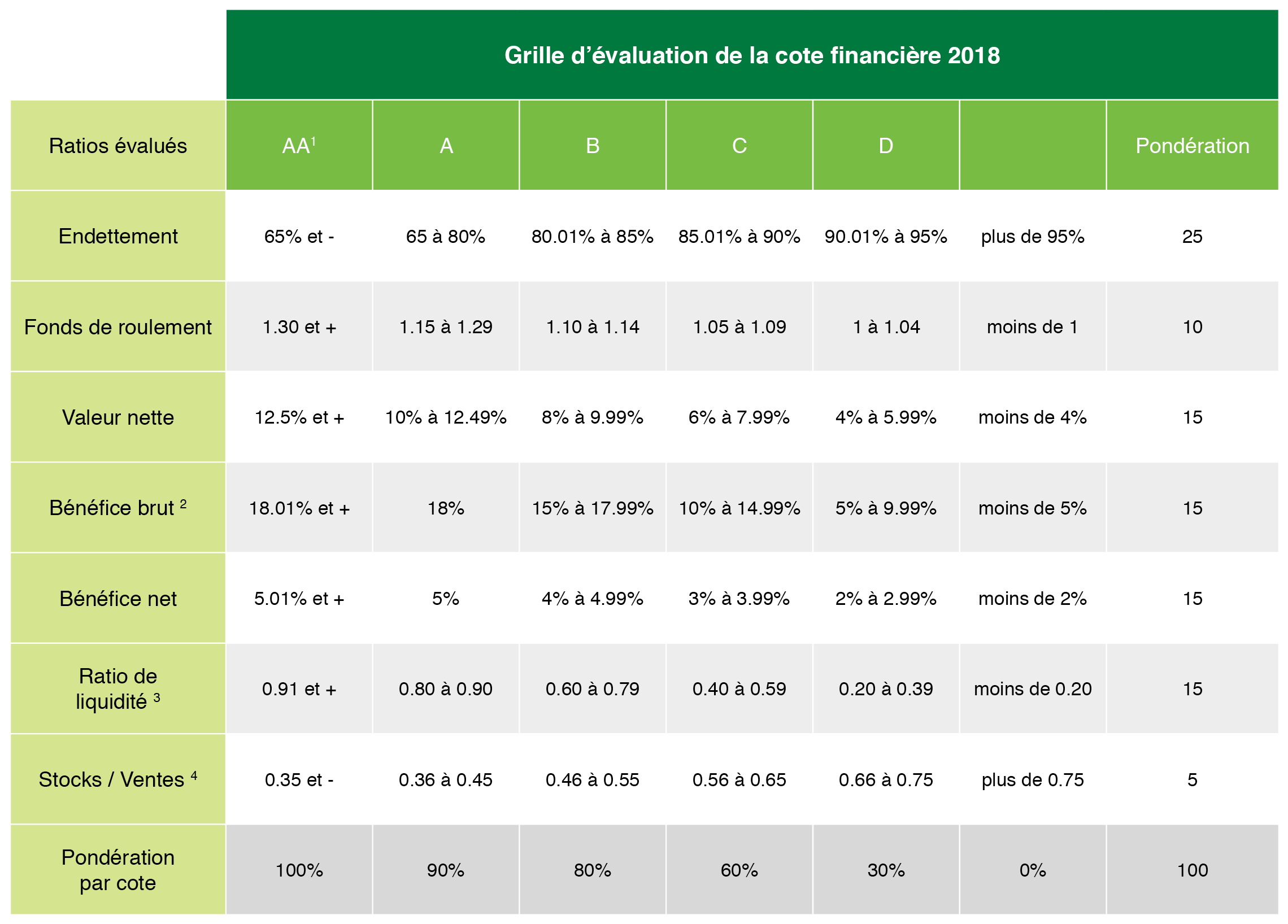

The financial rating has changed from being 50% of the overall assessment of the Cote Qualité GCR to 40% when the satisfaction rating is used. Some adjustments are planned for the financial rating’s evaluation grid. These changes are the result of constructive discussion between contractors and GCR.

Ratio assessment

The Accreditation Department assigns a financial rating based on five financial ratios provided for by the Regulation respecting the guarantee plan for new residential buildings: gross earnings, net earnings, capital ratio, debt/equity and net worth.

GCR also evaluates two other financial ratios: the cash ratio and the inventory-to-sales ratio. This financial rating is updated annually, based on the new financial statements provided with the review engagement report.

All financial ratios used to determine the Financial Rating are calculated based on the past three-year average.

Here is the evaluation grid for the 2018 financial rating, which has been in force for all membership renewals since March 1, 2018 (in french).

Ratio calculation method

| Ratio |

Calculation method |

| 1- Debt/equity ratio |

(Total liabilities minus debts to affiliated companies and board members) / (Total assets minus advances to affiliated companies and board members). |

| 2- Capital ratio |

(Short-term assets minus advances to affiliated companies and board members) / (Short-term liabilities minus debts to affiliated companies and board members). |

| 3- Net worth/sales ratio |

(Net worth plus debts to affiliated companies and board members minus advances to affiliated companies and board members) / Revenue |

| 4- Gross earnings ratio |

Gross earnings / Revenue |

| 5- Net earnings ratio |

Net earnings / Revenue |

| 6- Cash ratio (minus inventory) |

(Short-term assets minus advances to affiliated companies and board members minus inventory) / (Short-term liabilities minus debts to affiliated companies and board members) |

| 7- Inventory-to-sales ratio |

Inventory (including land) / Revenue |

GCR evaluation grid – Financial statements

The chart below outlines the adjustments made by GCR in the course of analyzing contractor financial statements.

| Assets |

| Short term |

|

Associates adjustment

If no repayment terms and/or no guarantee and/or interest rate 9.9% or less.

|

100 % |

|

Third-party adjustment

If no repayment terms and/or no guarantee and/or interest rate 9.9% or less.

|

100 % |

|

*All inventory, home inventory, ongoing construction, materials, model homes presented in the short term, etc. will be considered as inventory.

|

| Long term |

|

| Associates adjustment

Investments: any shares held in a private company. If no repayment terms and/or no guarantee and/or interest rate 9.9% or less. |

100 % |

|

Third-party adjustment

If no repayment terms and/or no guarantee and/or interest rate 9.9% or less.

|

100 % |

| Liabilities |

| Short term |

|

Associates adjustment

If no repayment terms and/or no guarantee and/or interest rate 9.9% or less.

|

100 % |

|

Third-party adjustment

If no repayment terms and/or no guarantee and/or interest rate 9.9% or less.

|

50 % |

| Long term |

|

| Associates adjustment

If no repayment terms and/or no guarantee and/or interest rate 9.9% or less. |

100 % |

|

Third-party adjustment

If no repayment terms and/or no guarantee and/or interest rate 9.9% or less.

|

50 % |

|

|

Definitions

Associates adjustment: any joint venture, cooperative, general partnership, limited partnership, subsidiary, company connected to board members or shareholders, sister company, parent company, board members, etc.

Third-party adjustment: parents, employees, friends, a close relative’s company, etc.

Adjustments: debts to associates, advance, loan, bill payable, amount outstanding, etc.

|

|

Notes

*Deposits on land will be added to inventory.

*The CPA auditor, CA or accounting firm must always sign your review engagement report.

*Adjustments are subtracted from the total amount of your assets and/or liabilities (short-term and long-term).

|

Important

GCR will not be able to assign a financial rating in the following cases:

- Notice to reader ;

- Opening balance sheet ;

- Financial statements demonstrating revenue less than $100,000 ;

- Interim financial statements.

Useful info

To increase your chances of receiving a AA Cote Qualité GCR, you must demonstrate an excellent financial balance sheet and construction quality that surpasses industry standards.

| Score required for the financial and technical ratings |

| AA |

91 points and above |

| A |

81-90 points |

| B |

71-80 points |

| C |

45-70 points |

| D |

44 points and below |